Santiago Trading Long-Term Investing Strategy

Santiago Trading - Long-Term Strategy

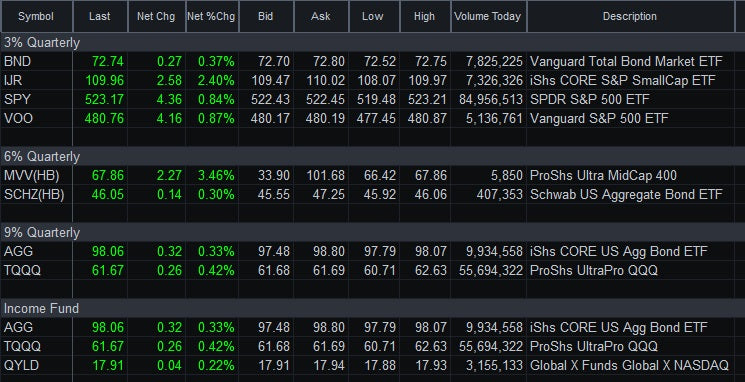

Trading a mix of several ETFs: 1) BND, IJR, SPY or VOO, MVV; 2) MVV and SCHZ; 3) AGG and TQQQ, or 4) AGG, TQQQ and QYLD allows you to invest in the most comfortable risk-management program for you. Our long-term investing strategy involves a strategic approach that focuses on maintaining a specific asset allocation to optimize portfolio performance. AGG (iShares Core U.S. Aggregate Bond ETF) tracks the Bloomberg Barclays U.S. Aggregate Bond Index, providing exposure to a broad range of U.S. investment-grade bonds. On the other hand, TQQQ (ProShares UltraPro QQQ) is designed to deliver triple the daily performance of the Nasdaq-100 Index, making it a suitable choice for investors seeking exposure to the technology sector.

For example, to achieve a 9% quarterly return, you would maintain a 40% allocation with AGG and a 60% allocation in TQQQ, it is crucial to perform quarterly adjustments to maintain the allocation. This ensures that the desired asset allocation is preserved, and that the portfolio remains in line with the investor's risk tolerance and investment goals. By regularly reviewing the performance of both ETFs and making any necessary adjustments, investors can effectively manage their portfolio and adapt to changing market conditions.

This approach allows investors to benefit from the diversification offered by AGG while capitalizing on the growth potential of TQQQ. By striking a balance between the stability of bonds and the potential for higher returns in the technology sector, this strategy can help investors achieve their long-term financial objectives.

The quarterly rebalance ensures that each of our plans maintains its desired growth trajectory by adjusting stock fund balances based on the target growth rates: 3%, 6%, or 9% growth in the stock fund per quarter.

At the end of each quarter, we compare the stock fund's balance with the target growth rate for the respective plan. If the stock fund balance surpasses the growth goal, we sell the excess and allocate the proceeds to the bond fund. Conversely, if the stock fund balance falls short of the growth goal, we use funds from the bond fund to buy the necessary shares to reach the target.

Our quarterly rebalance process focuses solely on the stock fund's performance, disregarding news or pundit opinions. The only factor that influences our decisions is the change in stock prices. This disciplined approach allows us to maintain a consistent strategy and maximize our clients' growth potential.